Agriculture Seminar – Autumn 2024

Case Study

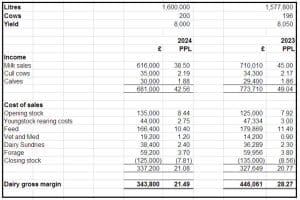

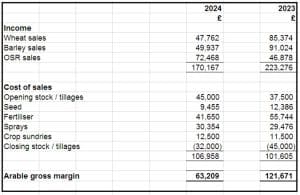

John (72 years) and Sarah (70 years) Kane are married and run a mixed dairy and arable farm based in the Southwest. They have two children: Daniel (46 years), married with two children. Daniel and his family live in Bristol and he works full time in the NHS.

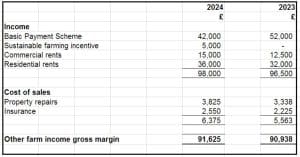

The farm comprises 600 acres of arable and pasture land, and includes the farmhouse in which John and Sarah live, a commercial letting unit, and 4 farm cottages, one occupied by Becky and the others are let on assured shorthold tenancies. There are also two barns with development potential and there is an option agreement for solar. The partnership has around £600k of bank borrowings.

All let property is held outside of the partnership and John receives the rents personally. John and Sarah have significant pension and share investments outside the farming business. They currently have no Wills or partnership agreement in place. John and Sarah have been considering the farm succession plan and how to split their assets between their children. They have had discussions with both their children. Daniel doesn’t want anything to do with the farming business and but wouldn’t be against some money to help his family pay off his mortgage. Becky is keen to take on the arable enterprise of the business but has no interest in the dairy. John and Becky had a disagreement during this discussion as John’s passion is the dairy farming enterprise. John appreciates that he cannot do this unsupported and therefore is open to alternative options from his consultant.

- The future of the farming business including options for the dairy business

- Their current inheritance tax position and implications of changing the business

- The development opportunities on the two redundant farm buildings

- Their succession plan and how to slit their assets between Daniel and Becky